Discover Top Credit Unions Cheyenne: Top Quality Financial Solutions Await

Discover Top Credit Unions Cheyenne: Top Quality Financial Solutions Await

Blog Article

Unlock Exclusive Benefits With a Federal Lending Institution

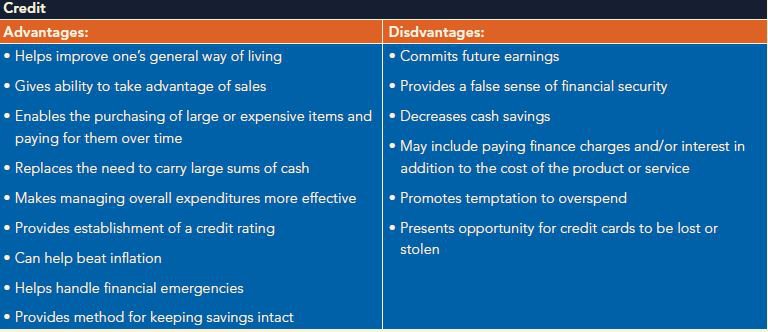

Federal Lending institution offer a host of exclusive benefits that can significantly impact your economic wellness. From enhanced financial savings and inspecting accounts to lower rates of interest on lendings and individualized economic preparation solutions, the advantages are customized to assist you conserve cash and accomplish your financial objectives much more effectively. Yet there's more to these advantages than simply economic benefits; they can also offer a complacency and community that exceeds standard banking services. As we discover even more, you'll uncover how these special benefits can truly make a difference in your economic journey.

Subscription Qualification Criteria

To come to be a member of a government credit union, people need to meet particular qualification requirements developed by the organization. These standards differ relying on the certain cooperative credit union, yet they commonly consist of aspects such as geographical location, work in a certain sector or firm, membership in a certain organization or association, or household partnerships to present participants. Federal cooperative credit union are member-owned monetary cooperatives, so eligibility requirements remain in location to make sure that people who sign up with share a typical bond or organization.

Improved Cost Savings and Checking Accounts

With enhanced financial savings and inspecting accounts, federal cooperative credit union provide participants exceptional monetary products created to optimize their cash management methods. These accounts typically include higher rates of interest on financial savings, reduced charges, and fringe benefits contrasted to typical banks. Members can enjoy attributes such as competitive dividend rates on cost savings accounts, which aid their money grow faster gradually. Inspecting accounts might provide advantages like no minimum equilibrium needs, totally free checks, and atm machine charge compensations. In addition, government credit unions commonly offer online and mobile banking services that make it convenient for members to monitor their accounts, transfer funds, and pay expenses anytime, anywhere. By making use of these improved savings and inspecting accounts, participants can maximize their financial savings potential and effectively manage their daily finances. This focus on offering premium monetary items establishes federal lending institution apart and shows their commitment to aiding participants achieve their economic objectives.

Reduced Interest Rates on Finances

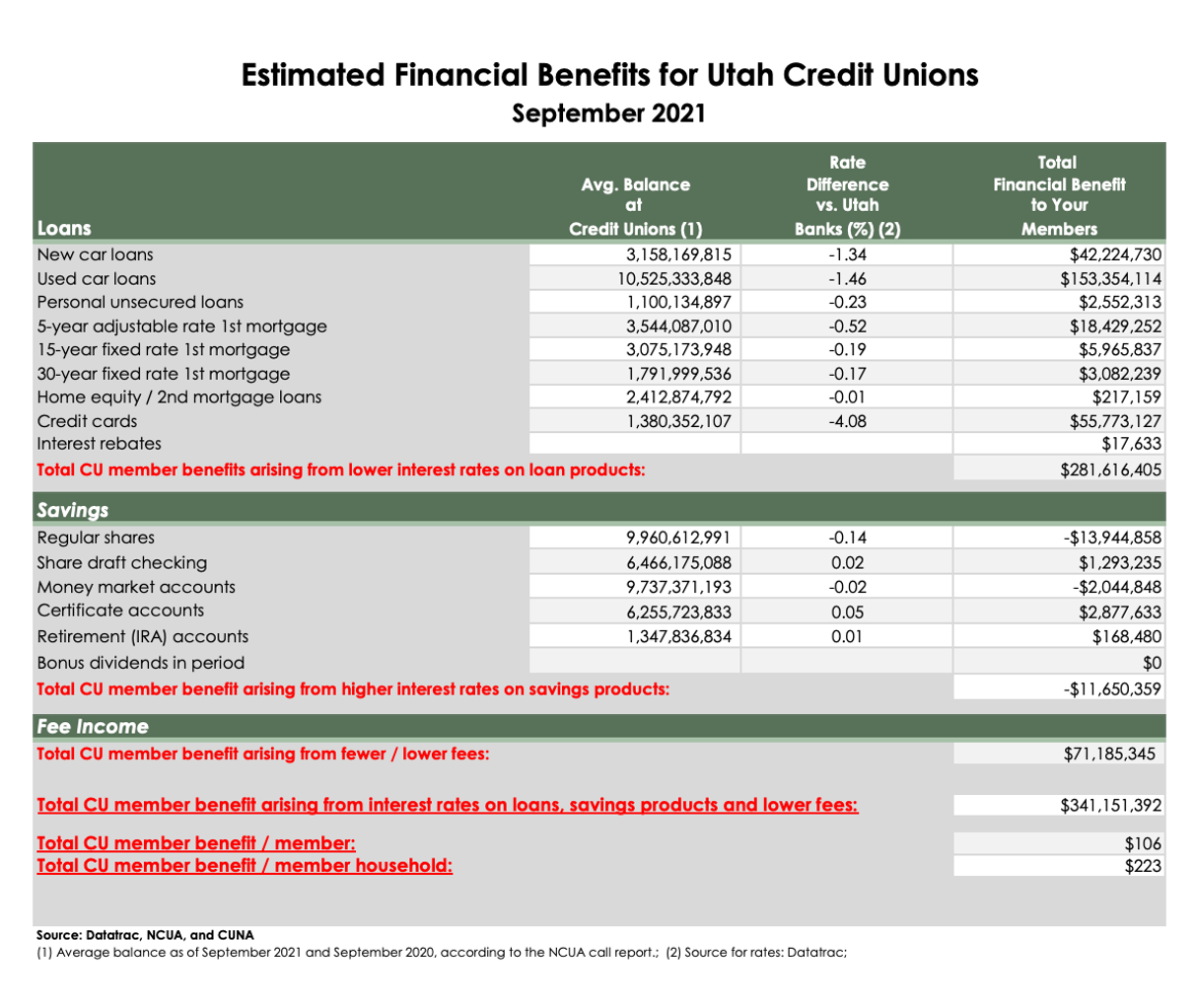

Federal credit rating unions provide members with the advantage of lower rates of interest on loans, allowing them to borrow money at more economical terms compared to other banks. This advantage can cause considerable financial savings over the life of a lending. Reduced passion rates indicate that consumers pay much less in interest costs, lowering the overall price of loaning. Whether members need a finance for a cars and truck, home, or individual costs, accessing funds through a government credit history union can result in extra favorable payment terms.

Personalized Financial Planning Provider

Given the concentrate on improving participants' financial well-being via lower rate of interest prices on loans, federal lending institution also provide personalized financial preparation services to assist people in attaining their long-term financial objectives. These individualized solutions accommodate members' details demands and circumstances, offering a customized strategy to economic preparation. By analyzing earnings, liabilities, possessions, and expenses, federal cooperative credit union economic planners can aid members create an extensive financial roadmap. This roadmap might consist of methods for conserving, spending, retirement preparation, and financial obligation administration.

Moreover, the individualized economic planning services offered by federal lending institution often come at a reduced cost compared to personal financial consultants, making them much more easily accessible to a broader variety of people. Members can gain from expert support and knowledge without sustaining high charges, aligning with the lending institution philosophy of focusing on members' economic wellness. Generally, these services objective to encourage participants to make enlightened economic choices, build wide range, and safeguard their financial futures.

Access to Exclusive Participant Discounts

Members of government cooperative credit union enjoy special accessibility to a variety of member discounts on various products and solutions. Credit Unions Cheyenne WY. These price cuts are a beneficial perk that can help participants save cash on daily expenditures and special purchases. Federal cooperative credit union usually companion with retailers, service suppliers, and various other organizations to supply discount rates exclusively to their participants

Members can take advantage of discounts on a selection of items, including electronic devices, garments, travel bundles, and Wyoming Federal Credit Union much more. Additionally, solutions such as cars and truck services, hotel reservations, and entertainment tickets might also be available at reduced prices for cooperative credit union members. These special discounts can make a significant difference in members' budgets, enabling them to take pleasure in financial savings on both vital items and deluxes.

Conclusion

Finally, signing up with a Federal Credit report Union supplies various advantages, including improved savings and inspecting accounts, reduced rates of interest on loans, customized financial planning solutions, and accessibility to exclusive participant price cuts. By becoming a participant, individuals can take advantage of a variety of monetary advantages and solutions that can aid them conserve money, prepare for the future, and strengthen their connections to the local community.

Report this page